Global Insights Hub

Stay informed with the latest updates and diverse perspectives.

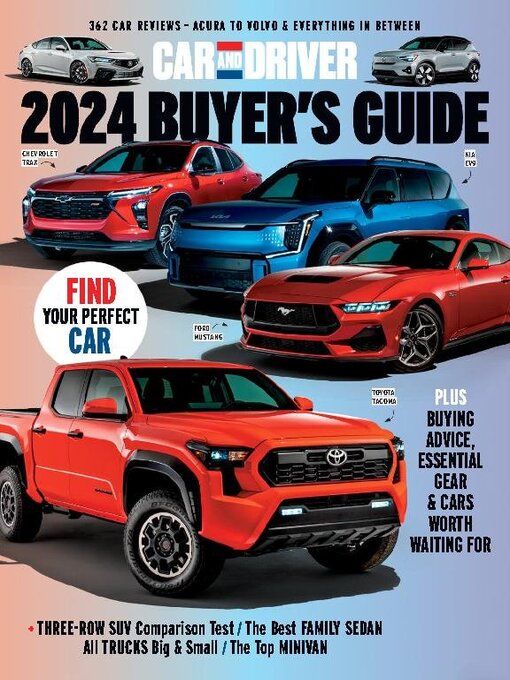

Buckle Up: Your Car Buying Adventure Starts Here

Get ready for the ultimate car buying journey! Discover tips, tricks, and insider secrets to drive home your dream car today!

Top 5 Tips for Stress-Free Car Shopping

Shopping for a new car can often feel overwhelming, but with the right approach, it can be a stress-free experience. Here are Top 5 Tips for Stress-Free Car Shopping that will help you navigate the process with ease. First, do your research. Investigate various makes and models online, focusing on reliability, customer satisfaction ratings, and pricing. Websites like Edmunds provide valuable insights and reviews that can guide your decisions. Next, set a realistic budget that considers not only the price of the car but also insurance, maintenance, and fuel costs.

Second, consider pre-financing. Before visiting dealerships, check with your bank or credit union for financing options. This will not only save you time but also give you a clear understanding of what you can afford. Third, take your time to test drive each vehicle you're considering. This is crucial for ensuring comfort and handling. Fourth, don’t hesitate to negotiate price and terms. Understanding the average market price can empower you to secure a better deal. Finally, don't rush the process. Car shopping should be a thoughtful endeavor, so take your time and ensure that you make the right choice. For more tips on negotiating, check out Consumer Reports.

What You Need to Know Before Visiting a Dealership

Visiting a dealership can be an exciting yet overwhelming experience, especially if you're a first-time buyer. Before you step foot inside, it's important to do your homework. Start by researching the make and model you’re interested in; resources like Edmunds provide detailed reviews and comparisons. Additionally, familiarize yourself with the current market value of the vehicle. Websites such as Kelley Blue Book offer pricing tools that can help you understand what to expect. This knowledge will empower you to negotiate better and avoid paying more than necessary.

Another key factor to consider is your financing options. Before heading to the dealership, it's wise to check your credit score and explore potential financing options. Many buyers overlook the importance of securing a loan in advance, which could save you a significant amount in interest rates. Additionally, understanding the dealership's policies regarding returns and warranties can help you make a more informed decision. Always read the fine print and don't hesitate to ask questions; transparency is crucial when making such a substantial investment.

How to Set Your Budget for a New Car: A Step-by-Step Guide

Setting a budget for a new car is a crucial step in the car buying process. To begin, assess your financial situation. Calculate your monthly income and expenses to determine how much you can realistically allocate towards a car payment. It’s advisable to follow the rule of thumb that suggests your car payment should not exceed 15% of your monthly take-home pay. Additionally, consider other costs associated with owning a car, including insurance, maintenance, fuel, and taxes, to ensure you have a complete picture of what your budget will entail.

Next, it’s important to research the type of car that fits within your budget. Create a prioritized list of must-have features versus nice-to-have extras, and use reputable websites such as Edmunds or Kelley Blue Book to find vehicles that meet your criteria. Once you’ve narrowed down your options, calculate the overall investment by estimating the car's total cost, including financing options, and compare various deals. Don’t forget to factor in trade-in value if applicable, which can offset some of the cost. By following these steps, you’ll be well on your way to confidently setting a budget for your new vehicle.