Global Insights Hub

Stay informed with the latest updates and diverse perspectives.

Forex Frenzy: Dancing with Currency Risk

Unleash your trading potential! Dive into Forex Frenzy and master the art of dancing with currency risk for profit.

Understanding Currency Risk: Key Concepts Every Forex Trader Should Know

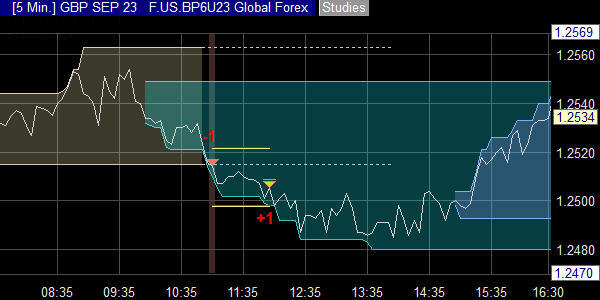

Understanding currency risk is crucial for every forex trader as it directly impacts profitability and overall trading strategy. Currency risk refers to the potential for loss due to fluctuations in exchange rates between two currencies. Traders must be aware of various factors that contribute to these fluctuations, including economic indicators, interest rates, and geopolitical events. A trader can effectively manage this risk by diversifying their portfolio and employing risk management strategies, such as setting stop-loss orders and using proper position sizing.

To navigate currency risk effectively, traders should familiarize themselves with key concepts such as exchange rates, forex risk, and volatility. Additionally, understanding how to analyze market trends and incorporate tools like technical analysis can enhance a trader's ability to foresee potential risks. Educating oneself on these topics not only prepares you for the unpredictable nature of forex trading but also helps in building a robust trading plan to mitigate losses.

Top Strategies to Mitigate Currency Risk in Forex Trading

In the volatile world of Forex trading, understanding how to mitigate currency risk is crucial for traders looking to protect their investments. One effective strategy is to employ hedging techniques, which involve taking a position in a security that offsets potential losses in the currency market. Traders can use instruments such as options or futures contracts to hedge against adverse price movements. For in-depth insights on hedging strategies, you can check out this informative article on Investopedia.

Another vital strategy is to stay informed about economic indicators and geopolitical events that can impact currency values. By following updates on interest rates, inflation, and political stability, traders can make more educated decisions to reduce exposure to currency fluctuations. Engaging in regular analysis and utilizing tools like economic calendars can aid in anticipating market movements. For useful resources on understanding economic indicators, refer to FXStreet's Economic Calendar.

How Does Currency Risk Impact Your Forex Trading Decisions?

Currency risk is a crucial factor that every forex trader must consider when making trading decisions. This type of risk arises from fluctuations in exchange rates, which can significantly impact the profit or loss incurred from a trade. For instance, if a trader decides to invest in a currency pair where one currency appreciates against another, they could experience heightened gains. Conversely, a depreciation of the chosen currency could lead to substantial losses. Thus, understanding how to manage currency risk is vital for optimizing trading strategies and minimizing potential losses.

Moreover, traders often utilize various tools and techniques to mitigate currency risk, such as hedging strategies, diversification, and careful market analysis. By keeping an eye on economic indicators, geopolitical events, and market sentiment, traders can make informed decisions that reduce their exposure to unfavorable currency movements. Resources like forex analysis can provide insights that help traders assess their risk and enhance their overall trading strategy to achieve better financial outcomes.