Global Insights Hub

Stay informed with the latest updates and diverse perspectives.

Whole Life Insurance: Your Money's Cozy Home

Discover how whole life insurance can secure your financial future and make your money work harder for you. Cozy up to smart investing today!

Understanding Whole Life Insurance: A Comprehensive Guide

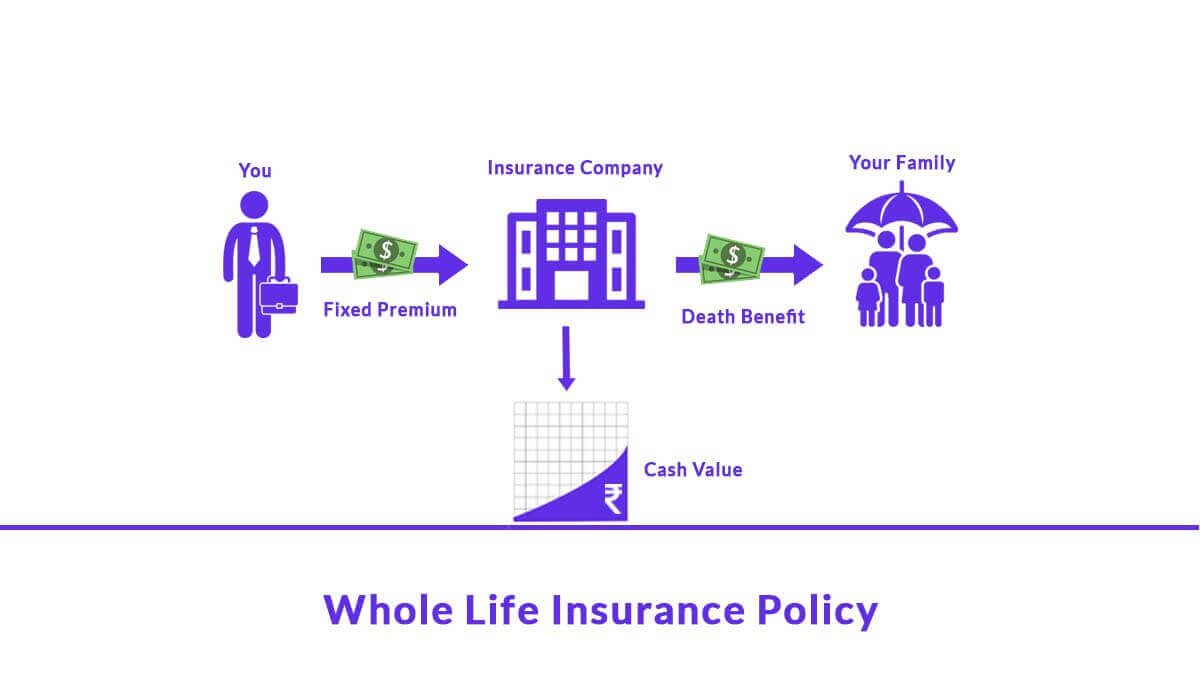

Whole life insurance is a type of permanent life insurance that offers lifelong coverage, making it a popular choice for those looking to ensure financial security for their loved ones. Unlike term life insurance, which provides coverage for a specified period, whole life insurance remains active as long as the premiums are paid. This policy not only serves as a safety net for your beneficiaries but also accumulates a cash value over time, which can be borrowed against or withdrawn if necessary. Additionally, the premiums are typically fixed, providing predictability in your financial planning.

When considering whole life insurance, it's essential to understand its key components. These include the premium costs, the death benefit, and the cash value accumulation. Below are important points to consider:

- Premiums: Whole life insurance usually has higher initial premiums compared to term policies.

- Death Benefit: Beneficiaries receive a guaranteed payout upon the policyholder's death.

- Cash Value: This grows at a guaranteed rate, offering a savings component.

Overall, understanding these elements can help you make an informed decision about whether whole life insurance fits your financial goals.

Is Whole Life Insurance Right for You? Key Questions to Consider

When considering whole life insurance, it's essential to evaluate if it aligns with your financial goals. This type of insurance provides not only a death benefit but also a cash value component that grows over time. Here are some key questions to ask yourself:

- What are my long-term financial objectives?

- Do I prefer the stability of fixed premiums over the years?

- Am I comfortable with the initial higher costs associated with whole life compared to term life policies?

Additionally, assessing your current and future financial situation is crucial. Consider the following aspects:

- Dependents: Do you have family members who rely on your income?

- Savings: How confident are you in your ability to save for retirement or other financial goals?

- Investment preferences: Are you interested in a policy that offers both a safety net and an investment component?

By answering these questions, you can better determine if whole life insurance is the right choice for you.

The Benefits of Whole Life Insurance: Secure Your Financial Future

Whole life insurance is a powerful financial tool that provides lifelong coverage while also accumulating cash value over time. One of the key benefits of this type of insurance is the level of security it offers. Unlike term life insurance, which only provides coverage for a specific period, whole life insurance ensures that your beneficiaries will receive a death benefit no matter when you pass away. Additionally, the cash value component grows at a guaranteed rate, allowing you to borrow against it or even withdraw funds in times of need, making it an excellent component of a long-term financial strategy.

Another significant advantage of whole life insurance is its stability and predictability. Premiums remain level throughout the life of the policy, meaning that you won't encounter unexpected increases. This reliability can aid in budgeting for your family’s future. Furthermore, the death benefit and cash value growth are not subject to market fluctuations, ensuring that your investment remains safe even during economic downturns. By choosing whole life insurance, you're not just securing your loved ones' financial future; you're also creating a foundation for your own financial peace of mind.