Global Insights Hub

Stay informed with the latest updates and diverse perspectives.

Travel Insurance: Your Best Friend or Worst Nightmare?

Is travel insurance your ultimate safety net or a costly trap? Discover the truth behind the benefits and pitfalls of travel insurance!

Understanding Travel Insurance: Essential Coverage You Need

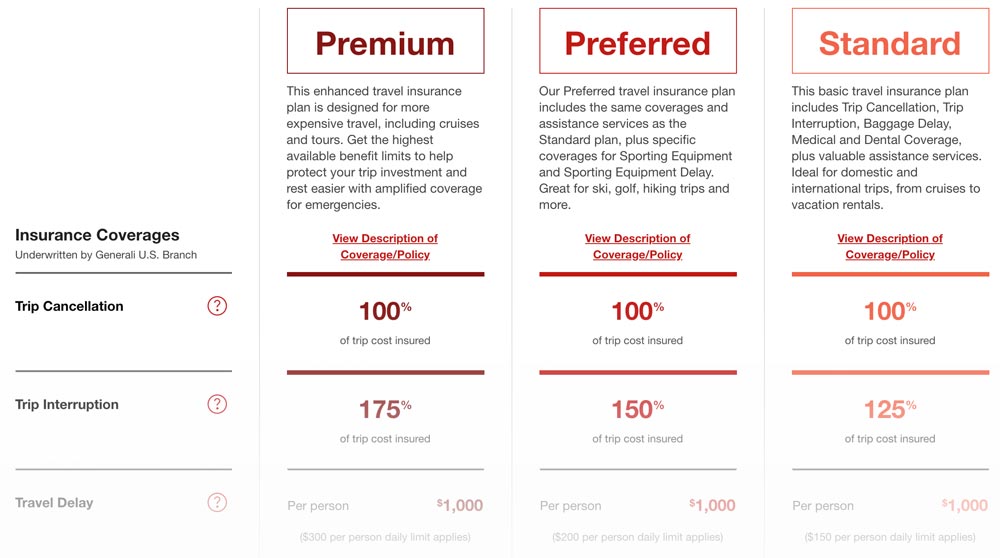

Understanding travel insurance is crucial for any traveler aiming to protect their investment and ensure peace of mind during their journeys. Travel insurance can cover various risks, such as trip cancellations, medical emergencies, and lost luggage. With numerous options available, it's essential to identify the key types of coverage that align with your travel plans. For instance, trip cancellation insurance can refund your expenses if you have to cancel your trip due to unforeseen circumstances, while travel medical coverage is vital for safeguarding against unexpected health issues abroad.

When selecting a travel insurance policy, consider the following essential coverages: medical expenses, trip interruption, and personal liability.

- Medical expenses: This covers emergency medical situations and hospitalizations.

- Trip interruption: This ensures compensation for lost expenses if your trip is cut short.

- Personal liability: This protects you against legal claims for damages caused to others.

Common Travel Insurance Myths Debunked: What You Should Know

Travel insurance is often surrounded by myths that can mislead travelers into making poor decisions. One common myth is that travel insurance is unnecessary if you have a credit card that offers some form of coverage. However, this is not entirely true. Credit card insurance usually comes with strict limitations and may not cover all situations, such as trip cancellations due to unforeseen emergencies. According to InsureMyTrip, relying solely on credit card coverage can leave you significantly under-protected.

Another prevalent misconception is that travel insurance only covers medical emergencies. In reality, travel insurance encompasses a broad range of coverage options including trip cancellation, lost luggage, and emergency evacuations. Many travelers are unaware that they can also claim reimbursement for costs related to canceled flights or accommodation expenses due to unforeseen events. TripInsurance emphasizes the importance of understanding the full scope of travel insurance to ensure you are adequately protected during your journeys.

Is Travel Insurance Worth It? A Comprehensive Guide for Travelers

When planning a trip, travelers often wonder, is travel insurance worth it? The answer largely depends on factors such as destination, type of trip, and personal circumstances. Travel insurance can provide peace of mind by covering unexpected events like trip cancellations, medical emergencies, and lost luggage. For instance, according to a report from the Insurance Information Institute, nearly one in five travelers encounter issues during their journeys that could have been alleviated by having insurance. Without coverage, you might be faced with costly bills that could easily break your budget.

Moreover, travel insurance can be particularly beneficial for international trips where healthcare costs can be exorbitant. For example, a simple doctor’s visit in countries like the United States or Canada can cost hundreds of dollars out of pocket. It is crucial to evaluate various policies to find one that suits your needs, as some plans offer comprehensive coverage while others are more basic. According to World Nomads, travelers should always read the fine print and understand exclusions to avoid surprises during their travels. In summary, weighing the potential risks against the cost of insurance can help you determine whether travel insurance is worth it for your next adventure.